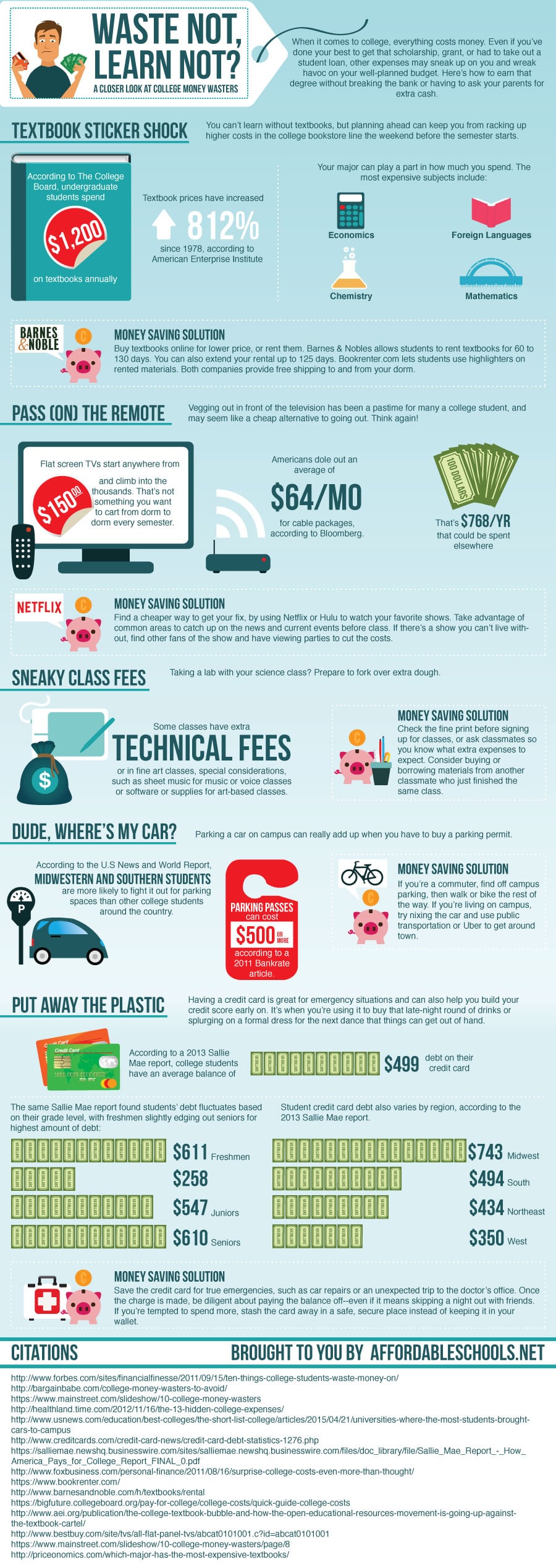

Waste Not, Learn Not? A Closer Look at College Money Wasters

When it comes to college, everything costs money. Even if you’ve done your best to get that scholarship, grant, or had to take out a student loan, other expenses may sneak up on you and wreak havoc on your well-planned budget. Here’s how to earn that degree without breaking the bank or having to ask your parents for extra cash.

Textbook Sticker Shock

You can’t learn without textbooks, but planning ahead for these expenses can keep you from racking up higher costs in the college bookstore line the weekend before the semester starts.

• According to The College Board, undergraduate students spend $1,200 on textbooks annually.

• Textbook prices have increased 812 percent since 1978, according to American Enterprise Institute.

• Your major can play a part in how much you spend. The most expensive subjects include Economics, Foreign Languages, Chemistry, and Mathematics.

• Money Saving Solution: Buy textbooks online for lower price, or rent them. Barnes & Nobles allows students to rent textbooks for 60 to 130 days. You can also extend your rental up to 125 days. Unlike Barnes & Noble, Bookrenter.com lets students use highlighters on rented materials. Both companies provide free shipping to and from your dorm, though.

Pass (on) the Remote

Vegging out in front of the television has been a pastime for many a college student, and may seem like a cheap alternative to going out. Think again!

• Flat screen TVs start anywhere from $150 and climb into the thousands, depending on specs. That’s not something you want to cart from dorm to dorm every semester.

• Americans dole out an average of $64 per month for cable packages, according to Bloomberg. That’s $768 a year that could be spent elsewhere.

• Money Saving Solution: Find a cheaper way to get your fix, by using Netflix or Hulu to watch your favorite shows. Take advantage of common areas to catch up on the news and current events before class. If there’s a show you can’t live without, find other fans of the show and have viewing parties to cut the costs.

Sneaky Class Fees

Taking a lab with your science class? Prepare to fork over extra dough. Some classes have extra technical fees attached, or in the case of fine art classes, special considerations, such as sheet music for music or voice classes or software or supplies for art-based classes.

• Money Saving Solution: Check the fine print before signing up for classes, or ask around amongst your classmates so you know what extra expenses to expect. Also consider buying or borrowing materials from another classmate who just finished the class you’re considering taking.

Dude, Where’s My Car?

Parking a car on campus can really add up when you have to buy a parking permit.

• According to the U.S News and World Report, Midwestern and Southern students are more likely to fight it out for parking spaces than other college students around the country.

• Parking passes can cost $500 or more, according to a 2011 Bankrate article.

• Money Saving Solution: If you’re a commuter, find off-campus parking, then walk or bike the rest of the way to campus. If you’re living on campus, try nixing the car altogether and use public transportation or Uber to get around town until it’s time to head home at the end of the semester.

Put Away the Plastic

Having a credit card is great for emergency situations and can also help you build your credit score early on. It’s when you’re using it to buy that late-night round of drinks or splurging on a formal dress for the next dance that things can get out of hand. Check out these numbers.

• According to a 2013 Sallie Mae report, college students have an average balance of $499 debt on their credit card.

The same Sallie Mae report found students’ debt fluctuates based on their grade level, with freshmen slightly edging out seniors for highest amount of debt:

• Average debt for freshmen: $611

• Average debt for sophomores: $258

• Average debt for juniors: $547

• Average debt for seniors: $610

Student credit card debt also varies by region, according to the 2013 Sallie Mae report.

Debt by region, from highest to lowest:

• Midwest: $743

• South: $494

• Northeast: $434

• West: $350

• Students at two-year colleges typically have less credit card debt than students who attend four-year universities.

• Money Saving Solution: Save the credit card for true emergencies, such as car repairs or an unexpected trip to the doctor’s office. Once the charge is made, be diligent about paying the balance off–even if it means skipping a night out with friends. If you’re tempted to spend more, stash the card away in a safe, secure place instead of keeping it in your wallet.

Sources:

http://bargainbabe.com/college-money-wasters-to-avoid/

http://healthland.time.com/2012/11/16/the-13-hidden-college-expenses/

http://www.usnews.com/education/best-colleges/the-short-list-college/articles/2015/04/21/universities-where-the-most-students-brought-cars-to-campus

http://www.creditcards.com/credit-card-news/credit-card-debt-statistics-1276.php

https://salliemae.newshq.businesswire.com/sites/salliemae.newshq.businesswire.com/files/doc_library/file/Sallie_Mae_Report_-_How_America_Pays_for_College_Report_FINAL_0.pdf

https://www.bookrenter.com/

http://www.barnesandnoble.com/h/textbooks/rental

https://bigfuture.collegeboard.org/pay-for-college/college-costs/quick-guide-college-costs

http://www.aei.org/publication/the-college-textbook-bubble-and-how-the-open-educational-resources-movement-is-going-up-against-the-textbook-cartel/

http://www.bestbuy.com/site/tvs/all-flat-panel-tvs/abcat0101001.c?id=abcat0101001

http://priceonomics.com/which-major-has-the-most-expensive-textbooks/

The Best Colleges

The Best Colleges The Lowest Costs

The Lowest Costs The Highest Returns

The Highest Returns